Picture a financial advisor navigating a whirlwind of client meetings, meticulously tracking complex investment portfolios, and diligently staying ahead of ever-changing regulations. Without a reliable CRM, this juggling act could easily turn into a chaotic mess. The best CRM for financial advisors can help them stay organized, efficient, and compliant, ensuring that they can provide the best possible service to their clients.

Toc

- 1. Why Independent Financial Planners Need a CRM

- 2. Key Features of a CRM for Independent Financial Planners

- 3. Related articles 01:

- 4. Choosing the Best CRM for Independent Financial Planners

- 5. Choosing the Best CRM for Financial Advisors

- 6. Related articles 02:

- 7. Frequently Asked Questions

- 8. Conclusion

- 9. The Future of CRM for Financial Advisors

In this comprehensive guide, we will delve into the essential features and considerations for selecting the best CRM for financial advisors. Whether you are an independent financial planner or part of a larger firm, this guide will provide the insights you need to enhance client experiences and foster sustainable growth.

Why Independent Financial Planners Need a CRM

Independent financial planners face unique challenges in managing their client relationships and growing their practices. A robust CRM system can be a game changer, addressing the specific needs of financial advisors:

- Managing a Growing Client Base: As your practice expands, delivering personalized service becomes increasingly complex. A CRM centralizes all client data, including communication history and financial objectives, allowing you to tailor your services effectively and build deeper, more trustworthy relationships. For instance, a financial advisor can segment clients based on their age, risk tolerance, or financial goals. This segmentation allows for targeted communication and personalized service. For example, a younger client with a high risk tolerance might be interested in growth-oriented investments, while an older client with a lower risk tolerance might prefer more conservative options. A CRM can help automate this segmentation process, saving advisors valuable time and allowing them to focus on providing tailored advice.

- Staying Organized and On Top of Deadlines: With a multitude of tasks to juggle—from scheduling meetings to tracking important milestones—a CRM’s features, such as automated reminders and task management, keep you organized. This ensures you never overlook critical deadlines. For example, a CRM can send automated reminders for important client meetings, regulatory deadlines, or follow-ups on investment performance. This ensures that advisors are always aware of upcoming tasks and can proactively manage their schedules.

- Building Trust and Nurturing Client Relationships: Long-lasting client relationships are the foundation of successful financial planning. A CRM enhances consistent communication, personalized outreach, and progress tracking, demonstrating your commitment to clients’ financial well-being and fostering unbreakable trust.

- Enhancing Client Engagement: A good CRM allows for personalized interactions based on individual client preferences and history. By leveraging data insights, financial advisors can engage clients in meaningful ways, ultimately leading to higher satisfaction and retention rates. While data-driven insights can be helpful for engaging clients, it’s crucial to avoid relying solely on algorithms and data points. Financial advisors should understand their clients’ individual needs and preferences beyond what the CRM reveals. For example, a client might be hesitant to invest in a particular asset class due to personal experiences or beliefs, which might not be reflected in the data.

- Tracking Compliance and Regulatory Changes: The financial services industry is heavily regulated, and staying compliant can be a daunting task. A CRM can help track necessary compliance tasks, document client interactions, and ensure that all regulatory requirements are met efficiently.

Key Features of a CRM for Independent Financial Planners

When searching for the best CRM for financial advisors, consider the following features tailored to meet the unique requirements of the industry:

Client Management

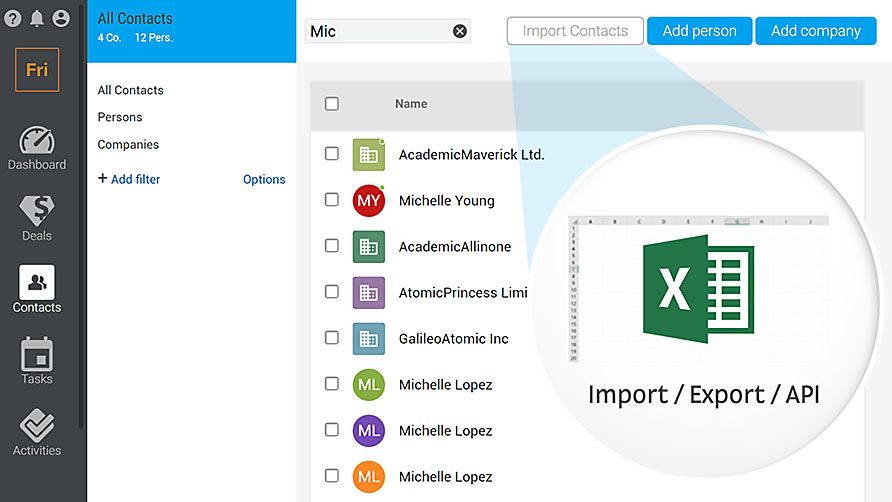

A CRM should be the central hub for all client information, providing a comprehensive view of each client’s financial goals, investment preferences, and communication history. Key features include:

Customizable Client Profiles: Track progress, milestones, and key dates specific to each client. This feature allows you to create a detailed roadmap for every client, ensuring that their unique needs are met.

Secure Data Storage: Ensure compliance with industry regulations by securely storing sensitive client data. Look for CRMs that offer encryption and robust access controls to protect this information.

Centralized Database: Access client contact details, financial records, and other relevant information from a single location, streamlining your workflow and improving efficiency.

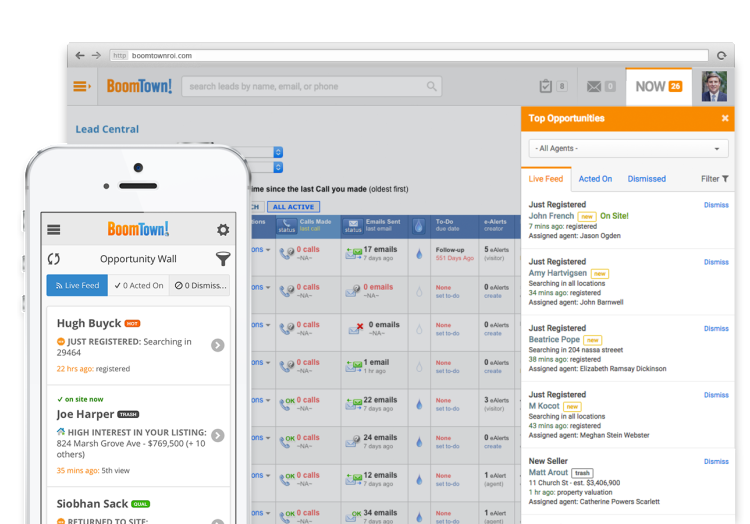

Lead Generation and Management

Attracting and nurturing new leads is crucial for growth. A CRM should offer:

Lead Capture Tools: Integrate with online forms, social media, and your website to capture leads effectively. This feature can help you streamline your marketing efforts and ensure no potential client slips through the cracks.

Lead Scoring and Prioritization: Focus your efforts on the most promising prospects by scoring leads based on their potential. This can help you allocate resources more effectively and maximize conversion rates.

Automated Follow-Up Campaigns: Build relationships and convert leads through automated email sequences and targeted outreach. This not only saves time but also ensures consistent communication with prospects.

Automation and Workflow

Streamlining repetitive tasks can free up valuable time for financial advisors. Look for a CRM that includes:

Automated Communication: Use email and SMS for reminders, newsletters, and important updates. Automation ensures that clients receive timely information, which can enhance their overall experience.

Task Management Tools: Efficiently assign, track, and complete tasks to optimize productivity. This feature allows you to delegate responsibilities and monitor progress, ensuring that nothing falls through the cracks.

Workflow Automation: Simplify common processes, such as onboarding new clients and managing follow-ups. Automation can significantly reduce the administrative burden on financial planners.

Scheduling and Calendar

Effective time management is essential for independent financial planners. Choose a CRM with:

1. https://chosloughi.org/mmoga-the-best-minors-for-computer-science-a-guide-for-prospective-students

3. https://chosloughi.org/mmoga-the-best-crm-app-for-small-businesses-in-2024-a-comprehensive-guide

4. https://chosloughi.org/mmoga-unlock-incredible-lenovo-laptop-deals-on-sale-for-back-to-school-season

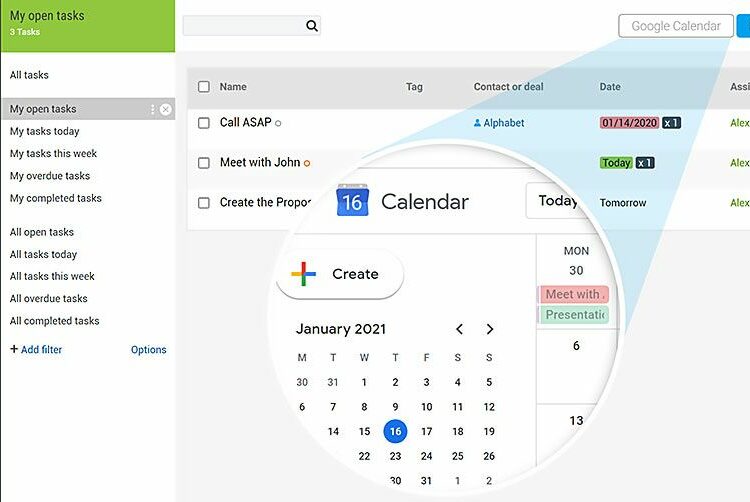

Integrated Calendar: Schedule client meetings, consultations, and follow-ups seamlessly. An integrated calendar helps you visualize your schedule and avoid double bookings.

Automatic Reminders: Prevent missed appointments and deadlines with built-in alerts. This feature can help you and your clients stay on track with important dates.

Calendar Integration: Sync with other calendars and productivity tools for enhanced efficiency. This ensures that your scheduling is cohesive across all platforms.

Document Management

Organize and securely store important client documents to ensure easy access and compliance:

Secure Document Storage: Protect client agreements, financial statements, and other sensitive files. Look for CRMs that offer secure sharing options to facilitate collaboration while maintaining confidentiality.

Version Control: Maintain accurate records by tracking changes to documents. This feature is particularly important for compliance and auditing purposes.

Accessibility from Any Device: Streamline workflows and improve client service by accessing documents anywhere. Cloud-based solutions offer the flexibility needed in today’s fast-paced environment.

Reporting and Analytics

Gain valuable insights into business performance and client behavior with comprehensive reporting features:

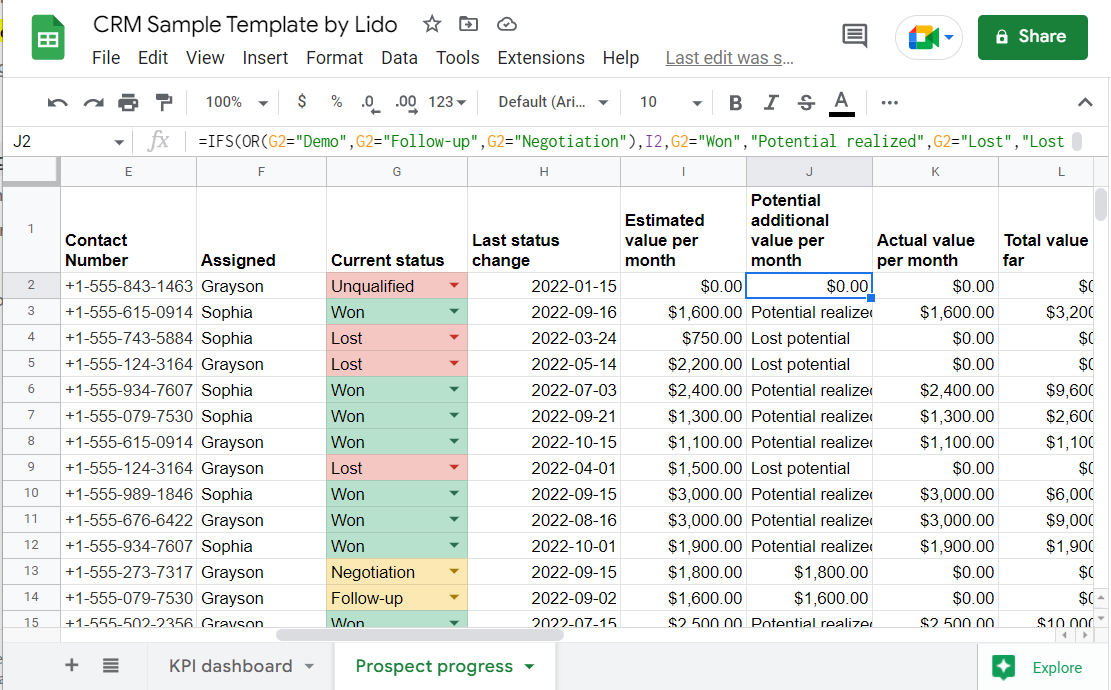

Customizable Reports: Track key metrics like client acquisition, sales conversion, and customer satisfaction. Tailoring reports to your specific needs can provide actionable insights for improving your practice.

Data Visualization Tools: Identify trends and areas for improvement through visual representations of data. Graphs and charts can make complex data more digestible and easier to analyze.

Data Export Capabilities: Export data for further analysis and reporting. This feature allows you to share insights with stakeholders or integrate data with other business intelligence tools.

AI-Powered Insights

A recent trend in the CRM industry is the integration of AI-powered insights. This technology can analyze vast amounts of data to identify patterns and predict client behavior. For example, an AI-powered CRM can identify clients who are at risk of churn or those who are likely to be interested in a new product or service. This information can be used to proactively engage clients and improve customer retention rates.

Choosing the Best CRM for Independent Financial Planners

When selecting the best CRM for financial advisors, consider these critical factors to ensure you find the right solution:

Ease of Use

A user-friendly interface and intuitive features are essential, especially for those new to CRM systems. Look for a clean dashboard, straightforward navigation, and comprehensive support resources to facilitate a smooth onboarding process.

Security and Compliance

Given the sensitivity of financial data, security and regulatory compliance are paramount. Ensure the CRM you choose offers robust encryption, secure data storage, and necessary safeguards to protect client information. Additionally, confirm that the CRM complies with regulations relevant to your practice, such as GDPR or FINRA.

Scalability

As your practice grows, your CRM should be able to grow with it. Look for solutions that offer flexible pricing plans, the ability to add users, and seamless integration with other financial tools and software. A scalable CRM can adapt to your evolving needs without requiring a complete overhaul.

Cost-Effectiveness

Balance the features you need with your budget. Explore free trials and affordable pricing plans to find a CRM that provides the best value for your financial planning practice. Be mindful of hidden costs, such as additional fees for premium features or user licenses.

Integration with Financial Planning Software

Seamless integration with financial planning software is crucial for financial advisors. This allows for the transfer of client data between systems, eliminating the need for manual input and reducing the risk of errors. For example, a CRM can integrate with financial planning software to automatically update client portfolios, track investment performance, and generate reports. This integration streamlines workflows and saves advisors valuable time.

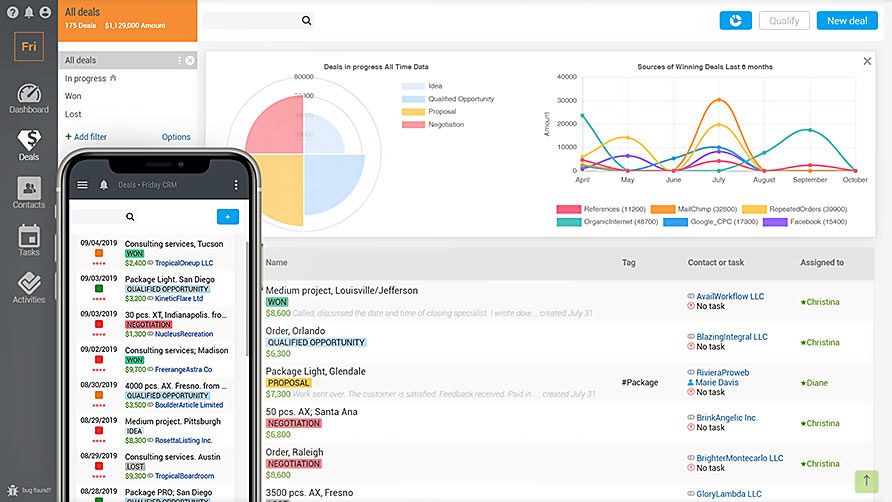

Choosing the Best CRM for Financial Advisors

To assist you in your search, here are some of the top CRM solutions tailored for independent financial planners:

1. https://chosloughi.org/mmoga-the-best-minors-for-computer-science-a-guide-for-prospective-students

3. https://chosloughi.org/mmoga-unlock-incredible-lenovo-laptop-deals-on-sale-for-back-to-school-season

4. https://chosloughi.org/mmoga-the-best-crm-app-for-small-businesses-in-2024-a-comprehensive-guide

EngageBay

EngageBay is an all-in-one CRM platform that provides a robust suite of features for marketing, sales, and customer service. Its affordable pricing, including a free plan for up to 15 users, makes it an attractive choice for smaller financial firms. With a user-friendly interface and comprehensive support resources, EngageBay ensures a smooth onboarding experience. Additionally, its marketing automation capabilities can help you nurture leads effectively.

Salesforce Financial Services Cloud

Salesforce is a leader in the CRM industry, and its Financial Services Cloud solution is specifically designed for financial advisors. This powerful platform offers advanced features like AI-driven insights, seamless integration with financial tools, and strong security and compliance features. While it may come at a higher cost, Salesforce’s comprehensive capabilities make it a top choice for larger or expanding financial practices. Its extensive customization options allow you to tailor the platform to fit your specific workflow and reporting needs.

Insightly

Insightly is known for its user-friendly interface and comprehensive features for managing contacts, leads, and opportunities. Although not specifically designed for financial services, Insightly’s affordable pricing plans, including a free option, make it a viable choice for independent financial planners. Its project management features can also help you track the progress of client engagements and internal initiatives.

Pipedrive

Pipedrive is a sales-focused CRM that can be particularly beneficial for financial planners looking to manage their pipeline effectively. Its simple and intuitive interface, along with powerful features for task automation and lead management, make it an appealing option for smaller financial planning businesses. Pipedrive’s sales forecasting capabilities can help you project future revenue and assess the health of your pipeline.

Frequently Asked Questions

Q: What are the key benefits of using a CRM for financial advisors?

A: A CRM helps manage client relationships, automate tasks, improve communication, and provide valuable insights into business performance.

Q: How do I choose the right CRM for my financial planning business?

A: Consider your budget, client base size, required features, and your level of technical expertise.

Q: What are some popular CRM solutions specifically designed for financial advisors?

A: EngageBay, Salesforce Financial Services Cloud, Insightly, and Pipedrive are popular choices.

Q: How can a CRM help me improve my client service?

A: A CRM centralizes client information, automates tasks, and provides insights to personalize communication and enhance the client experience.

Q: What are the security considerations when choosing a CRM for financial advisors?

A: Ensure the CRM offers encryption, secure data storage, and compliance with industry regulations to protect sensitive client information.

Q: Can I integrate my CRM with other financial tools?

A: Yes, many CRMs offer integrations with financial planning software, accounting tools, and other essential programs to streamline operations.

Q: How does a CRM improve lead generation for financial advisors?

A: A CRM centralizes lead data, automates follow-ups, and provides analytics to help advisors focus on the most promising prospects.

Conclusion

Selecting the best CRM for financial advisors can significantly enhance your practice, streamlining workflows, improving client relationships, and driving sustainable growth. By evaluating the features and capabilities discussed in this guide, you can find the perfect CRM solution tailored to your needs as an independent financial planner.

As you embark on your search, prioritize ease of use, robust security, scalability, and cost-effectiveness. With the right CRM in place, you can optimize your daily operations, gain valuable insights, and focus on what truly matters: helping your clients achieve their financial goals.

Start your journey towards improved client management and operational efficiency today by exploring the recommended CRM solutions. Discover how the best CRM for financial advisors can transform your practice and empower you to deliver exceptional service. Whether you are just starting or looking to upgrade your current system, the right CRM can make all the difference in achieving your business objectives.

The Future of CRM for Financial Advisors

As the financial services landscape continues to evolve, the future of CRM for financial advisors looks promising. Emerging technologies, such as artificial intelligence and machine learning, are set to play a pivotal role in enhancing CRM functionalities. Advisors can expect more advanced predictive analytics, enabling them to anticipate client needs and trends before they arise.

Moreover, the integration of financial wellness tools within CRM platforms is becoming increasingly important. Advisors will be able to offer clients a holistic view of their financial health, encompassing not just investments, but also budgeting and savings. This comprehensive approach will deepen client relationships and foster loyalty.

In conclusion, staying ahead of the curve by adopting the latest CRM technologies will be crucial for financial advisors aiming to provide exceptional service and drive growth in their practices.